- Road-To-Capital

- Posts

- RTC #21: 6 things you should know when fundraising as a first-time founder

RTC #21: 6 things you should know when fundraising as a first-time founder

Plus: Learn what separates the best founders from the less successful ones

👋 Welcome to ‘Road-To-Capital’ your weekly companion on startup financing, venture capital, and private equity. This newsletter is about tactical advice and the most relevant insights on raising capital and funding growth. Follow me along for weekly deep dives, and exclusive expert talks, and to stay ahead with the latest headlines and tools.

Brought to you by (Super)Analyst - Analyst-as-a-Service 🤓

Here is what (Super)Analyst is about:

👉 Analyst-as-a-Service

👉 Manage dozens of projects at once

👉 Deal support, research, and more

👉 Real people with tailored expertise

Why choose it?

✅ Save up to 70% on operational costs

✅ Cancel anytime

✅ Tailored expertise for superior results

Who can benefit?

👉 (Boutique) advisory and investment firms

👉 Family offices and PE/VC funds

👉 Solo advisors ready to scale their operations

Contact us to discuss your project.

Stay up-to-date with the latest headlines 📢

7 things that separate the best founders from the less successful ones

Two funds take almost half of the US VC fundraising in 2024 💰

The best insights from Sequoia Capital 💡

• How to run your startup in a downcycle

• Companies of the future: 2024 edition

Who is Sequoia Capital? One of the leading venture capital firms founded in 1972. Companies backed by Sequoia represent about 20 percent of the NASDAQ value.

Cold emailing billionaires works better than you’d expect

The probably MOST VIRAL POST on LinkedIn this week

The mixed state of startup funding in 2024

Definitely the LARGEST share buyback in US history (announced this week)

IPO environment:

China’s new plan to boost Hong Kong IPOs faces major hurdles

New VC funds investing in US & Europe 💸

Imec xpand, based in Belgium, has announced its new €300 million fund to foster semiconductor innovation

Department of XYZ, based in US, raises $5.1 million for crypto venture fund to back early-stage founders seeking to build trusted new financial systems

Boot64 Ventures, based in US, closed its Magnolia Fund I at $10 million to invest in early-stage startups

🤿 Deep Dive: Fundraising as a first-time founder

Let’s face the truth right from the start:

Being a first-time founder makes life pretty challenging.

Besides fundraising, your plate is full with tasks like product design and development, developing and executing a go-to-market strategy, acquiring first customers, and figuring out how to iterate on all thatt.

Plus, we should not overlook the “bigger” questions, such as:

What kind of company do you want to build?

What kind of people do you want to surround yourselves with?

What kind of culture do you want to create?

From a VC perspective, assessing your “fundability” boils down to two simple questions:

Is there any or no experience (“pedigree”)?

Is there any traction that proves “Product-Market-Fit” (“traction”)?

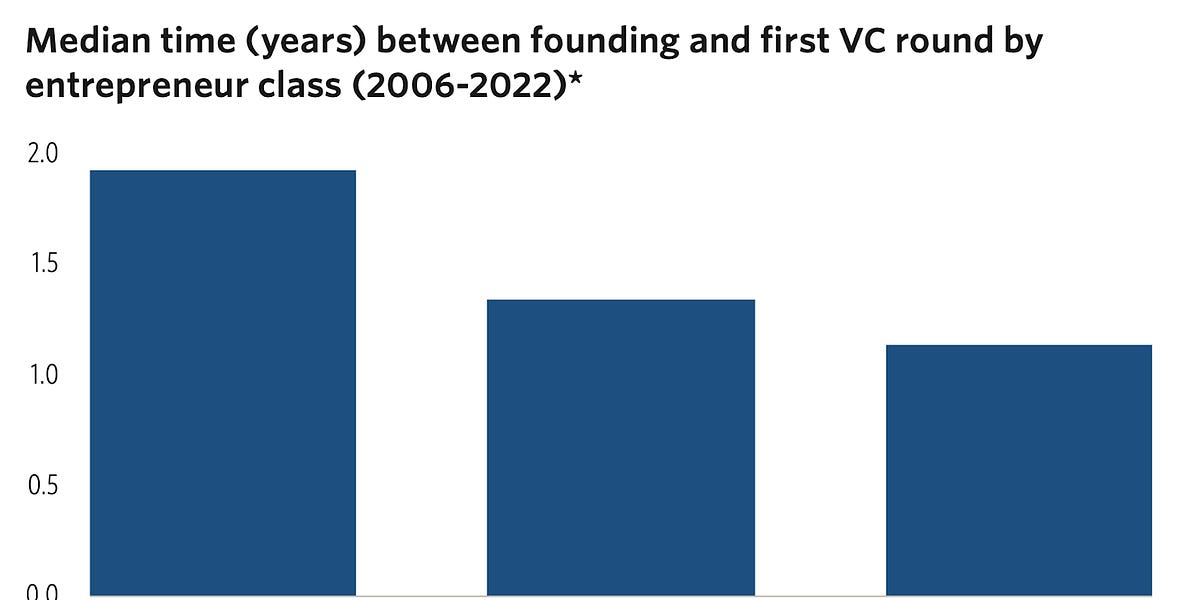

What does this graph tell us?

Firstly, life is great and relatively easy for a successful founder, especially when it comes to fundraising. 🏝️

Secondly, life is different for a first-time founder but here comes the good thing:

Knowing what to expect and how to prepare already increases your chances 💪🏼

And I do not mean more generic advice (which many founders still forget), such as:

Determine what type of investor you need

Know your business and your TAM

I am talking about practical, hands-on advice.

6 things you need to know when fundraising as a first-time founder

…and will help you prepare and increase your fundraising odds and bring you one step closer to being considered a successful founder one day 💡

1. Your best chances are with people who already know you (well)

It might not be what you want to hear, but often, your best chance initially is with those who already know you well—friends and family. At least for the very first months to “buy” you some time to secure other funding sources and create traction and technical milestones as potent evidence for future investors. No excuses, go and approach them right from the start. In addition, this will give you valuable feedback for future conversations and pitches.

2. (Quickly) build new relationships to increase your network of potential investors

Who are the most likely investors at your stage? Most likely it will not be Sequoia Capital but some angels that relate to your idea and/or product. But you need to be proactive, they will not come to you while you sit there and wait.

How do you start?

Suppose you are based in Austria/Vienna (or any other region)? The first thing I would do is to go on LinkedIn and search for 500 business angels/single investors in my area/country, filter their profiles for any fit with my idea, and get in touch!

3. LinkedIn profile beats pitch deck

Speaking about LinkedIn, your LinkedIn profile is your new business card—a fact many founders either overlook or maybe underestimate. In the very early stages, LinkedIn profiles may very well be more important than the actual pitch deck. Many investors will look at a founder's LinkedIn profile before deciding whether to take a first meeting or even take a closer look at a pitch deck. (Thanks, Antler!)

4. To raise money you need to impress

You cannot change your “pedigree” but you can enhance your “traction”. Focus intently on understanding the market opportunity and identifying who your customers are. This helps to create a product that meets these customer needs and, ideally, is adopted at an impressively rapid rate.

5. Product first, “pitch & party” second (or rather last)

Again, your product is your baby and it deserves your full attention. Don’t get sidetracked by glamorous conferences and pitching events. Yes, it’s fun to “pitch & party,” but ultimately, this does not secure funding or traction. “Pitching to clients,” on the other hand, offers direct insights into how to develop a product with strong market demand (which significantly increases your chances with investors).

6. Conferences are still relevant

Offline networking and creating personal relationships can be the game changer. But conferences only make sense when you approach them strategically.

How to maximize your conference experience? There is one rule: Prepare and select wisely to ensure your goals - whether for investors or clients - and the target audience are a perfect match

Useful reads before starting your first fundraising

📖 Report of the week

Experts extrapolate the past… and do harm when people believe them!

📅 Calendar of main VC events in the upcoming weeks

“Networking is a lot like nutrition and fitness: we know what to do, the hard part is making it a top priority.”

May

• Private Debt Investor Europe Summit | London, UK | May 7-8

• Emerging Founders | Warsaw, Poland | May 7

• EU-Startups Summit | La Valletta, Malta | May 9-10

• 0100 Conference CEE 2024 | Prague | May 14-16

• Impact’24 | Poznan, Poland | May 15-16

• Mashup | Malmo, Sweden | May 15-16

• Tech.eu Summit | London, UK | May 16-17

• Finovate Spring | San Francisco, US | May 21-23

• Infoshare | Gdańsk, Poland | May 22-23

• Viva Technology | Paris, France | May 22-25

June

• NOAH Conference | London, UK | Jun 3-4

• SaaStr Europe | London, UK | Jun 4-5

• SuperVenture | Berlin, Germany | Jun 4-6

• Money20/20 Europe | Amsterdam, The Netherlands | Jun 4-6

• SuperReturn International | Berlin, Germany | Jun 4-7

• Bits & Pretzels HealthTech | Munich, Germany | Jun 5-6

• South Summit | Madrid, Spain | Jun 5-7

• London Tech Week | London, UK | Jun 10-14

• TNW Conference | Amsterdam, The Netherlands | Jun 20-21

👉 Get the full list of events in 2024 here

This was it for today.

I wish you a great and successful week and see you next Tuesday.

Stay healthy,

Stephan 👋

Issue #21 | 7 May 2024

Reply